Part 1: Momentum and Friction on the Supply Side of the Grid

Let’s begin with a framing set of assumptions. Most businesses of any meaningful scale depend on electricity. Moreover, every business wants their electricity to be reliable in quantity, quality and affordability. And anything that disrupts a single one of those factors in electricity supplies is a business threat. If the business is energy-intensive, the threat warrants attention at senior levels.

If you agree with those propositions, and your role involves some measure of responsibility for your firm’s energy policies and procedures, then this blog series is for you.

This series is current to Q1 2025 and focused on the US electricity market. It examines the factors shaping the electricity supply that powers your business. It concludes with an examination of the choices over which you can maintain some agency in this context.

Renewable Momentum

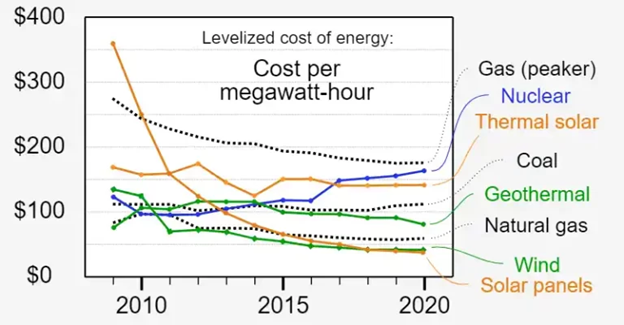

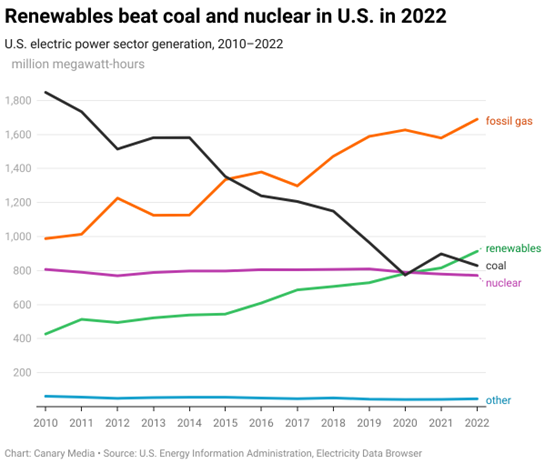

Over the last decade, renewable energy emerged as a major force in electricity grids. As it did, it reduced carbon emissions and it contributed to the quantity, quality and affordability of energy. This became possible through scale economics resulting a dramatic decline in the unit-cost of renewable energy.[1]

In parallel, public concern about climate change created political licence to policy-makers to fund incentives for renewable energy development. The finance sector responded to investor attention about climate risk as a portfolio-management factor creating pools of ESG capital looking for “shovel-ready projects.” And these factors, in combination with the low interest rate policies that trailed the great financial crisis of 2008 and the Covid pandemic of 2020 made it possible for grid operators to add renewable energy generation. It was on this basis that a substantial number of coal plants were retired from the grid, replaced by wind, solar and fossil gas.

Renewable Frictions

While the foundational economic and environmental drivers encouraging adoption of renewable energy have continued, a pendulum swing of resistance to the renewables trend has appeared.

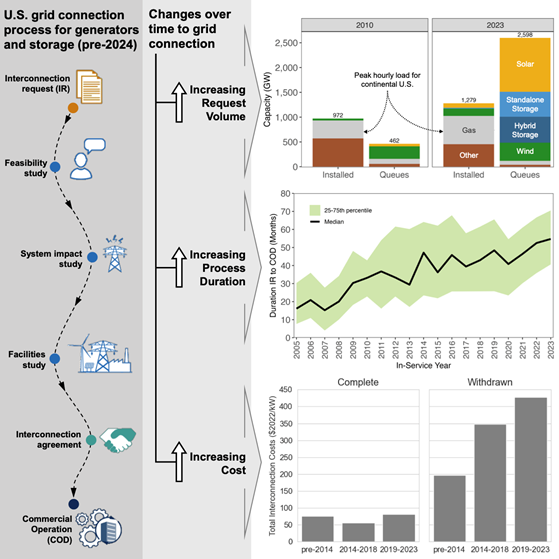

- There is a deep and growing backlog of applications for interconnection of renewable assets to the public grid. The majority of these shovel-ready projects expire while they sit in limbo as a result. The average renewable energy project that came online in 2023 was stalled for five years in the grid interconnection queue, according to a recent report from Berkely Lab.[2] According to the same source, the average backlog delay was three years for projects connected in 2015, and less than two years in 2008.

- The steps taken by central banks to reign in the post-pandemic inflation surge have increased borrowing costs. In the economics of renewable energy production, the interest on borrowed capital plays a role analogous to “fuel” cost for conventional fossil-powered energy. Higher interest rates during development = higher projected lifetime operating costs.

- The flow of investor funds to “ESG” investment vehicles has slowed down, in part due to cynicism created by green-washing practices that have been caught out and punished by regulators, investors and consumers.

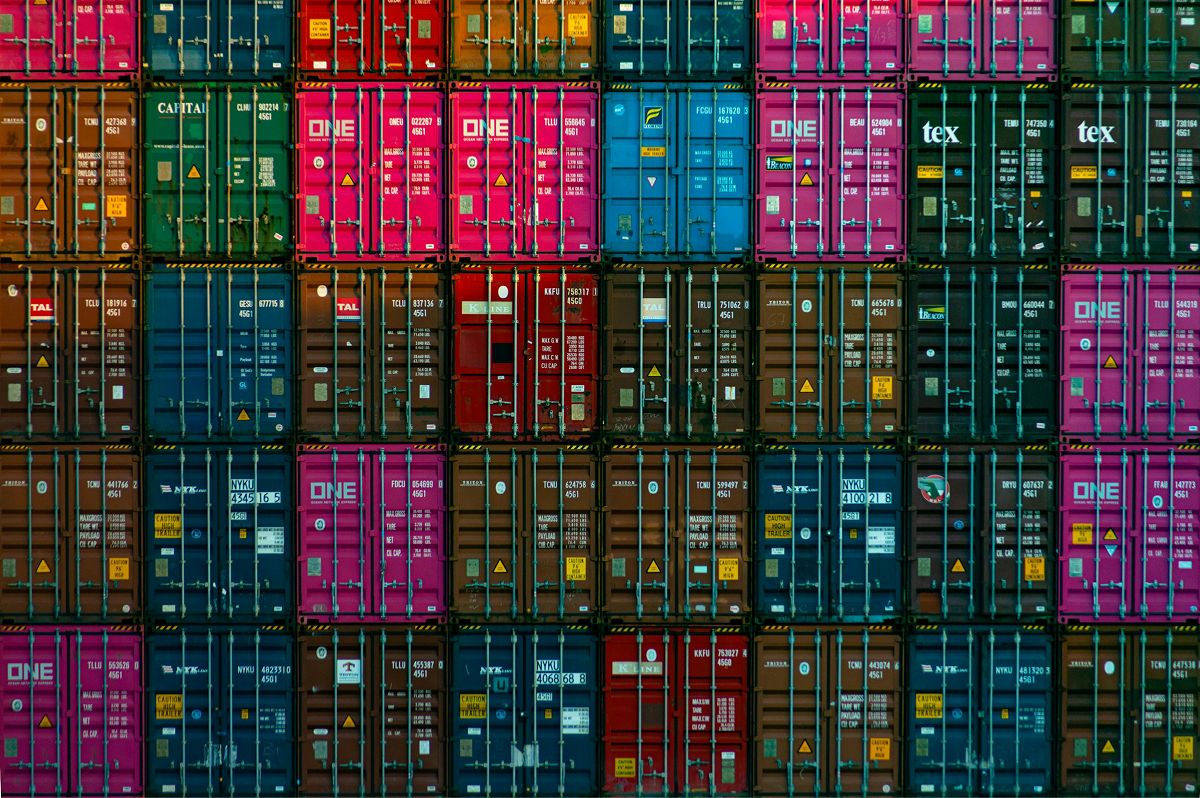

- In power-generation supply chains – there are some components – such as cables and transformers – predicted to face a persistent multi-year short supply scenario. [4] The IEA reports that “a survey of industry leaders found that procurement now takes two to three years for cables and up to four years for large power transformers – twice as long as in 2021.[5]” These supply-chain backlogs present a particular barrier to adding renewables to the grid, since cables and large-scale transformers are the two main ingredients in the High Voltage DC transmission networks that could connect affordably sourced renewable energy to urban centres with growing load profiles.

- Some components – PV panels, inverters and Battery Energy Storage systems fell subject to protectionist trade barriers under the Inflation Reduction Act – driving up unit costs and thus slowing the arrival of “grid parity.”

- In the public imagination, a portion of the attention that was once focused on climate is presently consumed by conflict, geopolitical competition, trade wars, and realignments of the alliances that have prevailed since 1945. Even in Europe – the pace of climate-response policy appears to be slowing with the 2025 omnibus bill watering down CSRD requirements, and a sudden shift in budget priorities towards continental re-armament.[6]

Taken as a set, these observations indicate that despite the ongoing decline in the theoretical cost to produce renewable energy, there’s quite a bit of friction in getting that energy onto the North American electric grid.

How concerned should electricity users be with the emergence of this friction and how it will impact the future cost and reliability of their energy supply? That’s a question we’ll develop in context of some demand factors we’ll study in part 2 of this series.

To be continued…

[1] What’s the cheapest source of electricity? – Aqua Switch

[2] Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection – Berkley Lab

[3] US grid connection backlog, dominated by solar, grows to 2.6TW in 2023 – PV Tech

[4] Building the Future Transmission Grid: Strategies to navigate supply chain challenges – IEA