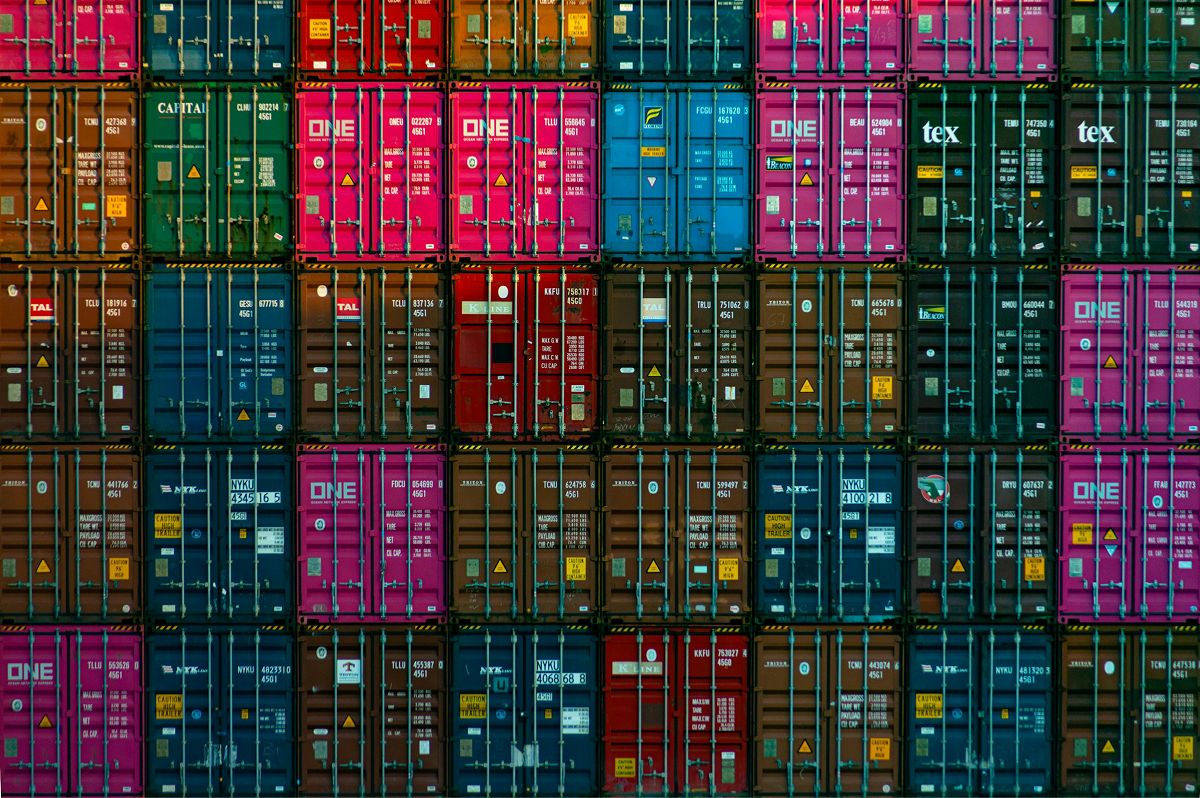

Let’s start with a lovely cocktail photo. Just because we’re old-fashioned that way.

And now to the matter at hand. Planning the energy mix during a period of rapid decarbonization.

This past winter, the Ontario Society of Professional Engineers gazed into the future of Ontario’s electrical supply. The executive report is here.

The subtitle of the report is: The Retail Price Impact of Net-Zero Supply Options.

As grids go, Ontario’s starting point is one of the cleaner ones in North America – coal was phased out entirely by 2008, and nuclear forms the bulk of the base-load. That being said, confronting the parallel challenges of:

- achieving net zero electricity generation by 2035, while at the same time

- shedding fossil fuels from automobile transportation, and

- shedding fossil fuels from the heating of buildings

well…it could nearly drive a person to drink.

Whether or not you embrace the OPSE findings entirely (the body acknowledges that there is considerable public debate on the topic of the most affordable net-zero energy mix) there are some useful precepts to be found in the report – precepts that will be applicable in other geographies.

One of these has to do with the shadows that follow around fossil-gas as an electricity feedstock. For perspective, fossil-gas is currently the largest electricity generation feedstock in America. Fossil gas (or “natural gas” as we’ve been trained to call it) has two climate forcing effects. The obvious one is the carbon dioxide emitted from combustion. The less obvious one that the PSSE report points to is leakage.

“Supply mixes A and B emissions also include a 3% leakage factor for natural gas from the well-head to the power plant with a 28x global warming potential (GWP) for methane (CH4) compared to carbon dioxide (CO2).”

Coming back now to the carbon dioxide emissions of fossil-gas – you would have to be living under a rock (or a table) if you had not heard some optimistic commentary about the potential for carbon capture. For instance, here’s what Aramco says about CCUS today:

“We believe carbon capture, utilization, and storage (CCUS) will play a role in global efforts to reduce greenhouse gas (GHG) emissions, while ensuring the world can continue to thrive.”

CCUS is not a new concept. The oil industry started the practice in the 1920s, to revive fading oil wells. As the Narwhal reports – the industry today is painting the practice green and asking the public to pay. Here on the other hand, from the report is what OPSE – a party with less vested interests – has to say about that:ᅠ

“We have not included the cost of carbon capture and storage (CCS). CCS costs are still too speculative to include in this cost study.”

Those two little sentences might save taxpayers a great deal of money if our public policymakers take them to heart.

Moving on from fossil gas to energy storage, the OPSE report again shares some very interesting precepts:

While the world races toward BESS (Battery Energy Storage Systems) to decarbonize the grid, OPSE shares an interesting comparison of BESS and pumped hydro.

“The energy losses for PHS are modelled as a 15% charging loss, 15% discharging loss and 1%/month leakage loss (evaporation and ground water leakage). Energy losses for BESS are modelled as 7.5% charging loss, 7.5% discharging loss and 5%/month leakage loss.

These losses include power conditioning and control system losses. While PHS is more expensive to build, it lasts much longer than BESS. As a result, the study found that PHS results in lower retail electricity prices for storage durations exceeding about 10 hours at full rated power.”

Ultimately, the report points readers to the conclusion that the most affordable energy mix, is a mix of both physical things like generation sources and also imaginative initiatives like community-scale waste heat recovery, and pricing plans that nudge electricity users to better match demand with supply.

Cheers to that.