To be read listening to Nelly’s 2003 R&B classic (Spotify, Apple Music).

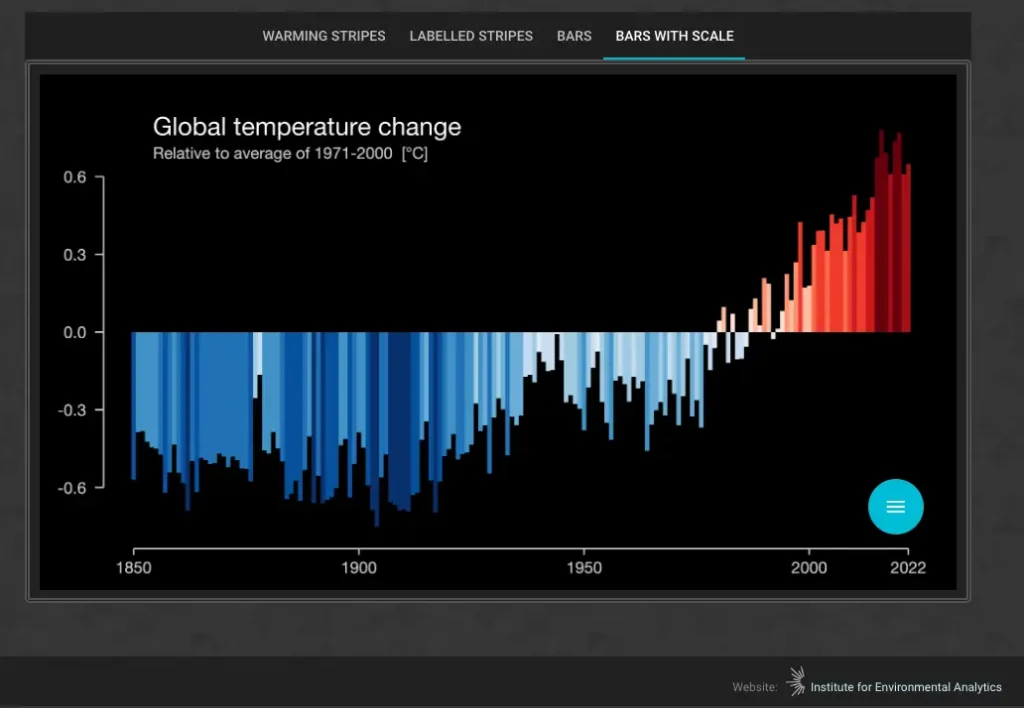

The earth is accumulating heat

Back in April 2023, the World Meteorological Association laid some important track in our understanding of this issue. Here’s the salient observation:

- The Earth has accumulated nearly 0.5 watts over every square meter of Earth’s surface over the past 50 years (since 1971);

- More recently (2006 to 2020), heating increased to more than 0.75 watts per square meter;

- Most heat entered the ocean (89%);

- Remaining global heat went into land (6%), ice (4%) and atmosphere (1%)

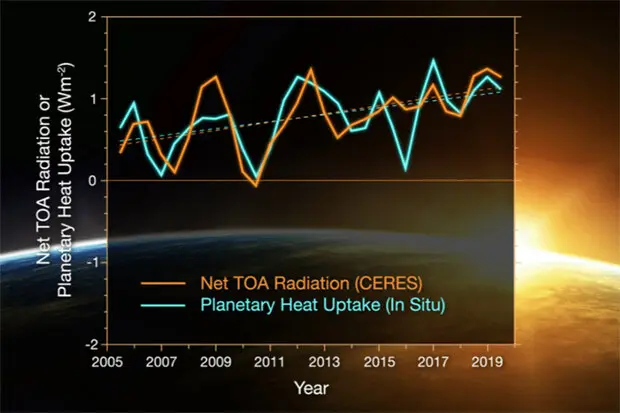

So now it’s July, and NASA has entered the room – this time with a graph that reveals the heat accumulation is accelerating. Those dots form a curve, not a line. We’ll come back to that.

Where are we putting all this heat? The oceans mostly (89%).

What does that look like?

Or viewed another way…

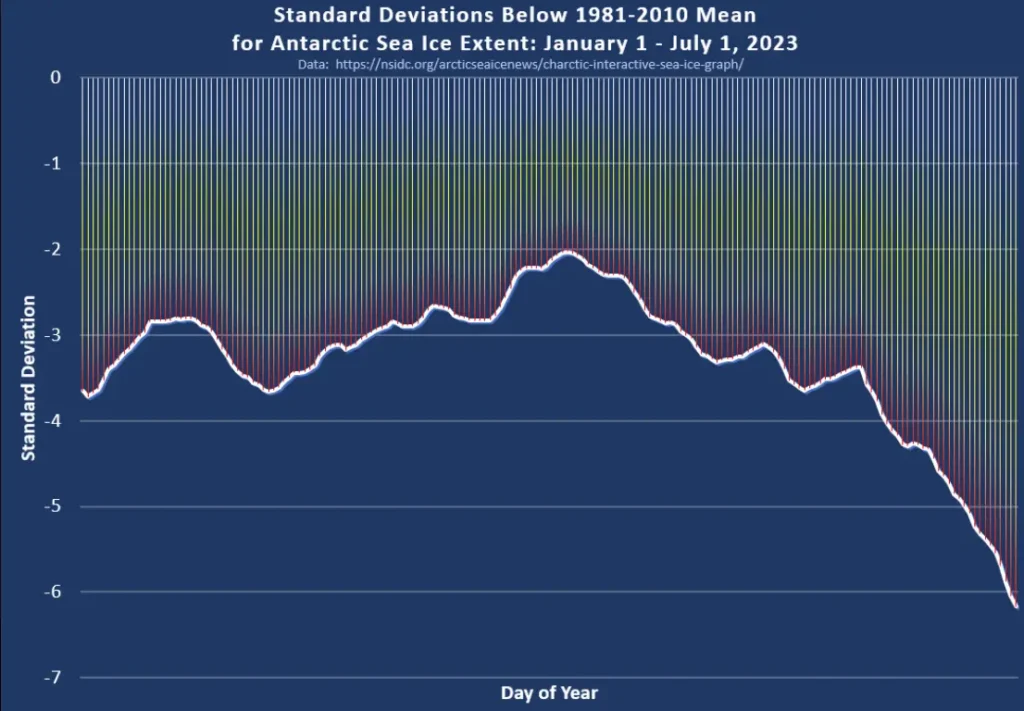

What do you suppose happens to sea ice, when you warm up the water surrounding it?

Something like that.

Now – what’s the point of sharing all these infographics? To be clear, our intention is explicitly not to persuade dug-in deniers of anthropogenic climate change. On that point we take to heart the hygienic observation about picking your battles that’s variously attributed to Mark Twain, George Bernard Shaw and Abraham Lincoln. How could all three be wrong?

On the contrary – our intention is to get on the radar of people who long ago discerned that climate change is real, man-made, and something we need to collectively manage towards a “safe-limit” boundary.

And our message: It’s time to recalibrate your sense of uncertainty.

Did you once feel you had a general notion of how much sea levels were rising per year, and consequently how long it would be before sea levels rose by a meter or two?

Did you once have a general notion of the carbon dioxide concentration boundary required to stabilize the rise in temperatures at 1.5 degrees?

How about now?

Looking back from today’s vantage point, it appears that we coddled ourselves with the collective illusion that using linear relationships, we could tentatively plot climate change impacts against a time-scale measured in centuries and centimeters. Ironically, the more data we have, the more that illusion is exposed. Emergent properties confound the comfort and sense of control that we find in predicting the future based on a model. What do we do now?

It may be time for people interested in climate change to take some lessons from an unlikely source of ecological wisdom – the finance industry.To be clear, we’re not talking about their climate pledges. Rather, we’re talking about their viewpoint on probability and prediction. In senior echelons of the finance world, a concept that is treated with due respect is “tail-risk.”

People who are attentive to “tail-risk” guide their decisions from the standpoint that “just because an event is improbable, that doesn’t mean it’s not going to happen.”

If you start with that stance, then what follows is greater attention to hedges:

Here’s Investopedia’s summary:

Although tail events that negatively impact portfolios are rare, they may have large negative returns. Therefore, investors should hedge against these events. Hedging against tail risk aims to enhance returns over the long term, but investors must assume short-term costs.

Given the patterns we’re seeing from NASA, NOAA, and the World Meteorological Association, it would appear to us that this kind of “tail-risk” thinking would be recommended at every level – from global institutions like the United Nations, on down to local communities and even family households.

Corporate perspective

So what might that kind of thinking look like for a corporate enterprise? Here are a few initial thoughts.

- A review of “place.” Where are your physical assets located? How vulnerable are they to tail-risk events like extreme weather, or sea level rise? There is help for this sort of thing, riskthinking.ai/.

- A review of “impact.” Imagine if legislation came along that placed the price of carbon emissions at the current price to capture and permanently sequester it.

Most enterprises are somewhere on the impact assessment and mitigation journey – but not many are hedged for that kind of scenario. Again there is help for this sort of thing – both on the consulting side, and in the SaaS sector where toolsets exist regardless of your organizational size, to help you take stock of your current state, assess what’s material, and prioritize action plans. At this present moment, some corporations and some national and state governments appear to be wavering on prior commitments to mitigating climate impact. A plausible scenario exists where both will find themselves playing an expensive game of catch-up.

- A review of “impact.” Imagine if legislation came along that placed the price of carbon emissions at the current price to capture and permanently sequester it.

- A review of the “supply chain.” For most enterprises, Scope 3 (i.e. emissions in the supply chain) averages about 70% of the total. If you anticipate a future scenario where you could be penalized much more heavily for emissions than you are today – then it’s your business to get involved with your suppliers around their emissions. And by the same logic, if your sell to other enterprises, you should anticipate that they will demand the same of you.

- And now a shameless plug…A review of your “energy platform.” Suppose the price of carbon credits skyrockets? Or suppose grid operators need to pass along to their customers the cost of a very rapid, and very large expansion of capacity? One hedge is for you to be pre-positioned with a very low-emissions electricity supply at rates you’ve contracted out over a long term contract. That’s the epitome of tail-risk management. Could this be a good time to price this kind of hedge?

In a predictable world, seeking more data, in order to make a more accurate prediction is a perfectly rational way to make decisions. But what about in an unpredictable world? Sometimes the prudent thing to do is embrace your state of uncertainty as the salient fact and go from there.