Powerful forces are converging to drive future electricity prices higher.

Whew! There is a lot going on these days. Let’s connect a few threads.

Current Affairs

Authoritarians are violating the post-WW2 norms governing military aggression that have created our modern world. The worst offenders spin their actions with justifications that nobody believes, or should. But as John Mearsheimer points out – there is no authority to constrain them. The impunity is terrifying – and that may be the precise point. “The strong do what they will, the weak suffer what they must.” That sentiment, penned, 2500 years ago, resonates anew.

Hopefully not too late, NATO nations – most of them governments that have struggled to get their citizens to support a 2% allocation of GDP to defense budgets – are reacting to the new geo-politics. At the June 2025 NATO summit, alliance members—including all G7 countries—agreed to a new baseline target of 5% of GDP for defense spending. [1] That’s a mind-blowing jump…a step-change in the financial obligations of governments all across the wealthy nations of the global North.

Currency

None of the G7 leaders who recently approved of a jump in targeted defense allocations from 2% to 5% could sincerely believe that a penny of that extra money for arms can come from anything but issuing debt and increasing M2 (ie “printing money”) to pay for it. Debt has already been compounding in the finances of most western countries in ways that have seasoned commentators like Jaimie Dimon and Ray Dalio sounding alarms that “the bond market will crack,” absent a deliberate and carefully managed deleveraging.

The debt problem pervades most wealthy societies, and in the US it’s about to take a turn for the worse. H.R. 1, the omnibus appropriations bill just passed, includes tax provisions that the CBO (Congressional Budget Office) associates with an additional $3.4 Trillion in primary deficits over the next decade.

Compounding debt points to a future of inflation and more expensive debt service.

Climate

Today’s public debt projections are based on an “all other things being equal” view of the need for public expenditures, but that might also be the wrong baseline assumption. Extreme weather events attributable to climate change are becoming more frequent and more costly. Those events have already caused a sharp rise in property damage, insurance premiums, public disaster recovery spending, and infrastructure repair costs. The Harvard Gazette reports that since 1980, climate change-related natural disasters have cost the U.S. more than $2 trillion in recovery costs. The growing cost of recovery from extreme weather will need to be absorbed by the economy – either through new productivity or more debt.

Productivity

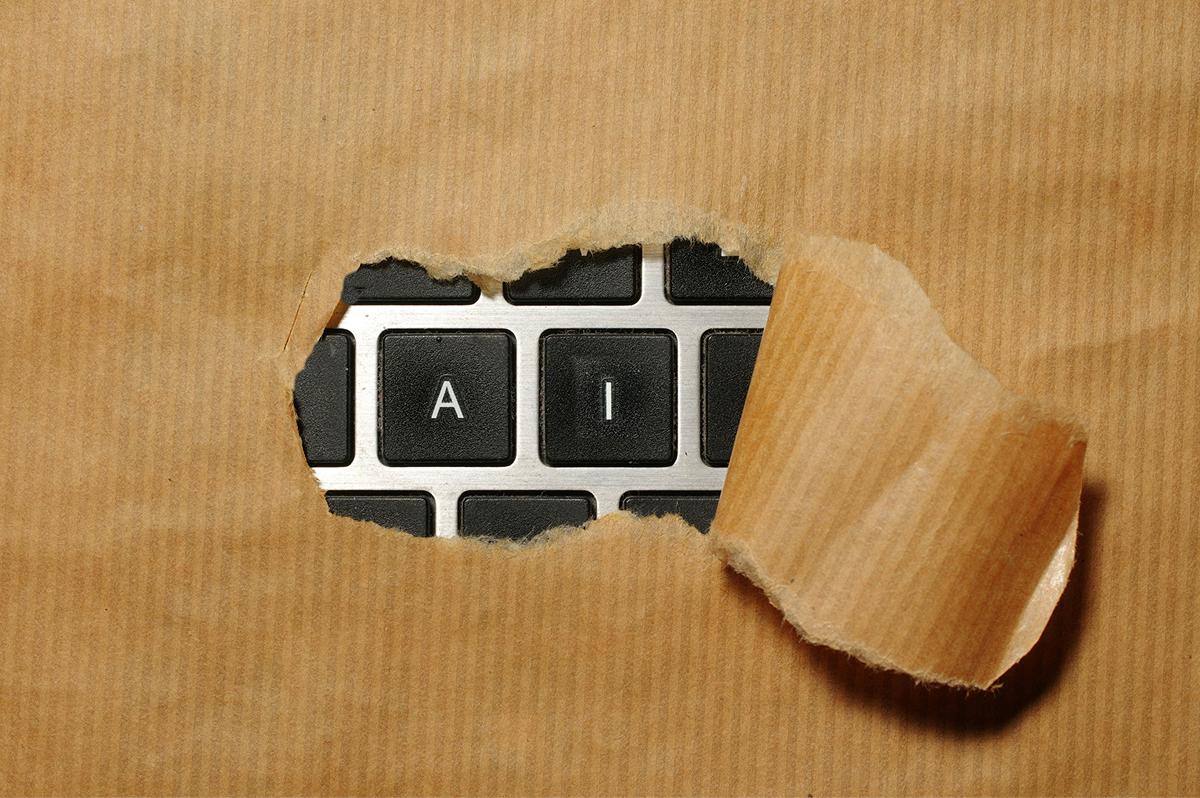

GDP Growth – Mostly Tepid

Source: https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

For the wealthy nations of the global north, there is a post-war baby boom aging out of the workforce, resulting in deeper social transfer obligations, and leaving behind a smaller workforce of productive tax-paying citizens to support this cost. GDP-growth is generally slow as has been long predicted by demographers. A tax base, thus constrained, is predisposed to debt accumulation.

Against this gloom, one vector of innovation shines with a promise of productivity gains. AI – “Artificial intelligence” is changing the way we get work done. Leaders of developed nations around the world are fixing on AI to improve productivity in their economies – and understandably so. Think about tasks like meeting notes, translation, and researching facts and correlations, and writing software code. All are achieved more quickly than before, thanks to the astounding jump in computing power, and the maturation of algorithms that have been decades in the making, now coming into broader usage.

We should expect to see evidence of faster progress in technical and scientific fields like materials research, drug discovery, and software development. Hype aside, AI is a major change in how humans get things done.

Current

This burst of new possibilities from AI is fueling a wave of investment in AI computing data centres. These centres are competing for access to electricity (and water) wherever they go. Ireland, a bellwether, sees 21% of the electricity on its grid go to power data centres. That’s more electricity than homes consume in Irish towns and cities.

In America, according to the IEA, power consumption by data centres will be responsible for roughly half of the growth in electricity demand in the US between now and 2030. (Reshoring industry and electrifying vehicle transport will play a role too). Overall, the National Association of Manufacturers predicts a 25% increase in electricity demand between 2023 and 2030. What will it cost to add all this capacity to the US grid? Deloitte estimates an additional $1.4 Trillion between now and 2030. How do you suppose we will we pay for it?

Currency and Current

It’s time now to pull some threads together.

Let’s assume these trends as observed today continue to converge:

- Mounting government debt and compounding debt service costs

- An aging/tapped-out tax base

- More government social payment obligations

- Mounting disaster-recovery costs

- Deep new infrastructure investment required to capture the productivity promise of AI

- Expansion of M2 (“money printing”) to handle debt service obligations and new deficits

Where does all this point?

- We will need to bring more electricity onto the grid.

- The money to fund this infrastructure will need to be borrowed in an environment of increasing scepticism towards the long-term buying power of a dollar.

- The effect of this scepticism will be an increase in financing cost for the new infrastructure.

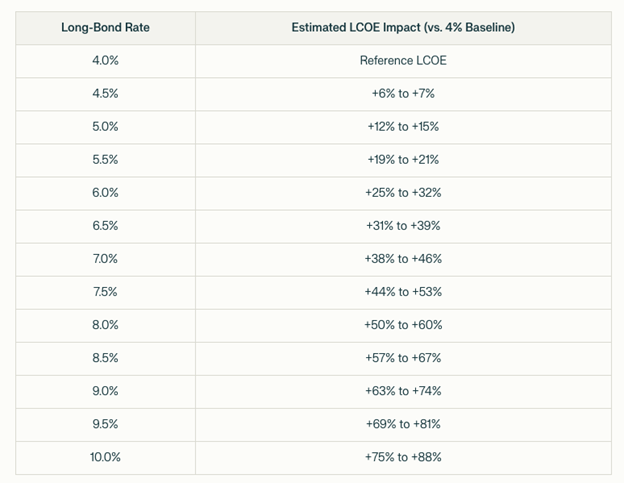

How might this affect the future price of electricity? According to an industry rule of thumb, a one percentage point increase in weighted average cost of capital can raise LCOE (Levelized Cost of Electricity) by 10%–15% for capital-intensive infrastructure like transmission and distribution. That rule of thumb results in this distribution of scenarios:

If 1/5th of the electricity you are able to buy is added according to the cost-of-production scenarios here, that could have quite a bearing on your power bills.

What do these scenarios say?

While the previously mentioned H.R. 1 bill will remove tax credits for renewable energy investment, the business case for such investments may persist for companies exposed to future electricity prices. If electricity is a key operating cost factor, then one would want to explore options to hedge against electricity cost inflation – through some combination of efficiency improvements, captive generation, power-purchase agreements or other such hedges. The alternative position would be that of an unhedged speculator, shorting a commodity with a price being shaped by a convergence of geo-politics, demographics, climate-change and the long-term debt cycle. That does not look like a prudent bet.