In Oct 2021, COP 26 Glasgow gave the world a hint that capital markets were going to reshape the environmental practices of corporations around the world. Mark Carney – recently the head of the Bank of England – assembled GFANZ, a group of the world’s largest financial asset managers – Blackrock, Vanguard, banks, insurance companies etc.. Together they had the financial clout to communicate a message to to the market:

“There’s money available to fund the transition to a sustainable economy.”

What has happened since? The idea that we should protect the planet from emissions that force climate change has become politicized – especially in the US where state governments led by Republican administrations have taken steps to interfere with a trend toward the greening of finance. The headline for this movement is the “Anti-ESG” backlash. Quite a number of ESG branded investment vehicles have been created and unwound since.

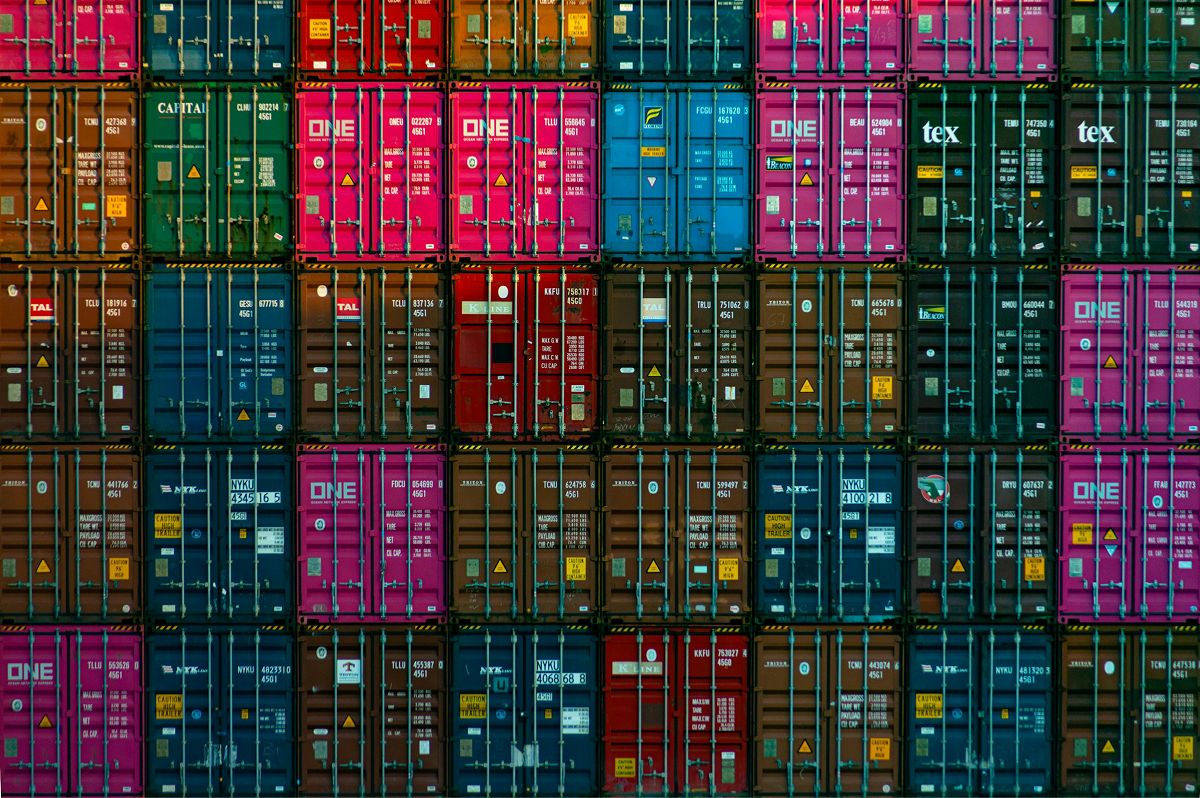

But – it appears that ING Bank, based in the Netherlands,

has managed to resist this backlash.

According to news published by the Financial Times: ING CEO has put clients on notice that their climate transition plans are part of credit-worthiness.

CEO Van Rijswijk said ING had assessed 2,000 of its largest clients based on their publicly available climate transition plans and other data. Companies had until 2026 to make sufficient progress, he said. “Our goal is to make sure we fight climate change. It is not to say goodbye to clients,” he said. “But if it is about them not being willing [to address their carbon footprint] then that will mean we will say goodbye.”

It is a notable move on the part of ING. Will it create a trend back to the economic logic that propelled GFANZ? If so, CFOs will be paying more attention to the agendas and outcomes of their C-suite peers with sustainability mandates.

Climate risk is financial risk. If our financial institutions follow ING and operate with that fact in the foreground of their business relationships, it will distribute the responsibility for action on climate to corporations with the greatest capacity for modifying climate outcomes.

Perhaps it comes as no surprise that this signal emerges first from a bank that is situated in a country that is vulnerable to catastrophic impacts from sea-level rise. But no matter where our banks are located, none of us are truly insulated from the effects of global climate change. And so CFOs should today be more curious about the state of sustainability reports and plans in their enterprises. It could affect the cost of funding operations.

Image Source: The Financial Times (https://www.ft.com/content/56529549-ef9a-4cb2-b613-d2ba867a8e56)